They borrowed some boats without asking to cross a body of water and then the platoon dumbass unloads on some locals observing the borrowing in progress with blanks from his M60 and that’s how it starts.Lousiana National Guard out in the swamps for a weekend and they do something to some backwoods people, can't remember what exactly or much else but they get hunted.

-

Be sure to read this post! Beware of scammers. https://www.indianagunowners.com/threads/classifieds-new-online-payment-guidelines-rules-paypal-venmo-zelle-etc.511734/

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Japan Crashing

- Thread starter Super Bee

- Start date

The #1 community for Gun Owners in Indiana

Member Benefits:

Fewer Ads! Discuss all aspects of firearm ownership Discuss anti-gun legislation Buy, sell, and trade in the classified section Chat with Local gun shops, ranges, trainers & other businesses Discover free outdoor shooting areas View up to date on firearm-related events Share photos & video with other members ...and so much more!

Member Benefits:

Hopes and dreams. And the CIA.And bitcoin is backed with what?

Ok, you've convinced me. Where can I buy a roll.or two of bitcoins?

- Energy expended to secure the network: The computational power and energy invested in maintaining the Bitcoin network and verifying transactions.

- Mathematics and cryptography: The underlying algorithms and encryption techniques that enable secure, decentralized, and censorship-resistant transactions.

- Scarcity: The limited supply of Bitcoin, capped at 21 million, which helps maintain its value.

- Demand: The market demand for Bitcoin, driven by its perceived value as a store of value, medium of exchange, and unit of account.

- Blockchain technology: The decentralized, distributed ledger that records all transactions, ensuring transparency and immutability

Just google Bitcoin ATMs or ask your broker.

I would pay to see that!

How about a silent charity auction.

Yep, one of my local BP/Headshop stations has one.Wow, and I accomplished something I didn't even set out to do! I am amazing!

Just google Bitcoin ATMs or ask your broker.

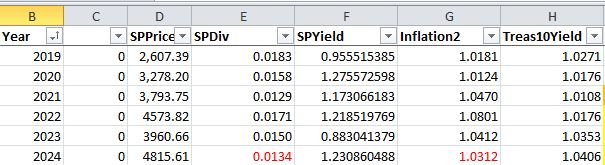

Yes, there has been inflation. And the last few years have been higher than average (although nothing compared to the 1970s and early 1980s). The market far outperforms inflation over time. I actually wrote a stock-market monte-carlo simulator using the S&P500 (and its predecessors) from 1871 through 2024. It's not even close. There is a greater than 8% spread between stock market yield (averaging 10.4%) and inflation (averaging 2.2%). Even the bond market (based on 10-year Treasury yields) doubles inflation over time.. "inflation"

BTW you are incorrect about "zero growth since after adjusting for inflation".

Attachments

Got it , thanks. I ordered 2 rolls to start off with.Wow, and I accomplished something I didn't even set out to do! I am amazing!

Just google Bitcoin ATMs or ask your broker.

I am not a financial guy, nor am I a numbers guy so perhaps it is my ignorance which prohibits me from understanding how the performance of the stock market is supposed to compensate for inflation. Almost every time I see someone mentioning inflation someone comes along to tout how strongly the stock exchange is doing. I get that the two are obviously connected but for me personally, how the stock market is doing is meaningless as far as my cost of living is concerned.

All I see from the cheap seats is the devaluation of the dollar.

All I see from the cheap seats is the devaluation of the dollar.

I like your outlook, but it seems your numbers are suited to generational dollars. How many folks are going to live to see the advance in the ~150 years of growth? Am I misunderstanding your words? That’s always a possibility.Yes, there has been inflation. And the last few years have been higher than average (although nothing compared to the 1970s and early 1980s). The market far outperforms inflation over time. I actually wrote a stock-market monte-carlo simulator using the S&P500 (and its predecessors) from 1871 through 2024. It's not even close. There is a greater than 8% spread between stock market yield (averaging 10.4%) and inflation (averaging 2.2%). Even the bond market (based on 10-year Treasury yields) doubles inflation over time.

BTW you are incorrect about "zero growth since after adjusting for inflation".

As an aside, I agree with you 100%. But most folks want their dollars to work faster for them. At the very least keep up with the Fed. Res. thievery.

I am not a financial guy, nor am I a numbers guy so perhaps it is my ignorance which prohibits me from understanding how the performance of the stock market is supposed to compensate for inflation. Almost every time I see someone mentioning inflation someone comes along to tout how strongly the stock exchange is doing. I get that the two are obviously connected but for me personally, how the stock market is doing is meaningless as far as my cost of living is concerned.

All I see from the cheap seats is the devaluation of the dollar.

If depends on your individual circumstances. If you don't have any money in the stock market, then how well it's doing doesn't help you. But if you have a significant investment, then the increases in dividends and capital gains far outpace your increases in cost of living. (And this includes 401(k) and IRA retirement funds if you have a large amount invested.)

I like your outlook, but it seems your numbers are suited to generational dollars. How many folks are going to live to see the advance in the ~150 years of growth? Am I misunderstanding your words? That’s always a possibility.

As an aside, I agree with you 100%. But most folks want their dollars to work faster for them. At the very least keep up with the Fed. Res. thievery.

The 150 years is just to give the broadest scope of data to the simulator. What the simulator does is allows you to compare your present financial situation against 150 years of past performance to see how likely you will do. So for example you plug in your specific financial information and ask it to predict the next 30 years for you. It's not 100%. The future is not always the same as the past. But to quote Mark Twain: "History doesn’t repeat itself but it often rhymes".

The basic version of the Retirement Investing Calculator Simulator I wrote is free and available for Android or iPhone.

Again I may be mistaken, but aren’t capital gains taxed? Did your equation take that amount into consideration?If depends on your individual circumstances. If you don't have any money in the stock market, then how well it's doing doesn't help you. But if you have a significant investment, then the increases in dividends and capital gains far outpace your increases in cost of living. (And this includes 401(k) and IRA retirement funds if you have a large amount invested.)

That's all ok if ALL your money (including what you have to spend to maintain or hopefully increase your standard of living) were invested. The problem with inflation is, I believe, that inflation outpaces wage growth and since people are required to spend an ever increasing percentage of their income to maintain their standard of living, less and less is left to invest in a market that might outpace inflation. The end result is declining standards of living, particularly for the middle class.Yes, there has been inflation. And the last few years have been higher than average (although nothing compared to the 1970s and early 1980s). The market far outperforms inflation over time. I actually wrote a stock-market monte-carlo simulator using the S&P500 (and its predecessors) from 1871 through 2024. It's not even close. There is a greater than 8% spread between stock market yield (averaging 10.4%) and inflation (averaging 2.2%). Even the bond market (based on 10-year Treasury yields) doubles inflation over time.

BTW you are incorrect about "zero growth since after adjusting for inflation".

I’ve found that most people attempting to make a financial point will cherry pick numbers. Such as from point A to point B, then use the results to justify their point of view.The 150 years is just to give the broadest scope of data to the simulator. What the simulator does is allows you to compare your present financial situation against 150 years of past performance to see how likely you will do. So for example you plug in your specific financial information and ask it to predict the next 30 years for you. It's not 100%. The future is not always the same as the past. But to quote Mark Twain: "History doesn’t repeat itself but it often rhymes".

The basic version of the Retirement Investing Calculator Simulator I wrote is free and available for Android or iPhone.

In no way am I saying that is what you have done.

If you want to use a broad scope use 2000 years and gold.

Got it , thanks. I ordered 2 rolls to start off with.Wow, and I accomplished something I didn't even set out to do! I am amazing!

Just google Bitcoin ATMs or ask your broker.

I tried to put one in a candy machine, but it wouldn't fit in the coin slot.You are a very wealthy man .... or at least were.

Staff online

-

GodFearinGunTotinSuper Moderator

-

d.kaufmanStill Here

Members online

- JRR85

- worddoer

- tommyj223

- HnK

- ancjr

- nettinyahoo

- Dentoro

- joe138

- Jin

- glank09

- TLHelmer

- NHT3

- tradertator

- bobzilla

- bacon#1

- Bennettjh

- crookcountygo

- drgnrobo

- ductape

- PappyD

- GodFearinGunTotin

- Dr.Midnight

- Born2vette

- Brandon

- craigkim

- printcraft

- d.kaufman

- Ozzy17

- DoggyDaddy

- deo62

- tca1352

- red@cted

- BR8818

- wcd

- wildcatfan

- singlesix

- Timjoebillybob

- dman65

- Jdubbs

- Firehawk

- drillsgt

- GLC3

- ChristianPatriot

- jagee

- XDdreams

- Squid556

- indychase

- chezuki

- 2A_Tom

- apache67

Total: 8,950 (members: 253, guests: 8,697)